16 March 2009

Ya herd? Using Micro-Loans to Raise Goats and Climb out of Poverty

Much has been written about the benefits of micro-finance recently, especially since Bangaldeshi Muhammad Yunus and his Grameen Bank, won the Pulitzer Peace Prize in

2006. To briefly summarize, micro-finance is the provision of financial services to poor people in developing countries who lack access to the commercial banking system. For those unfamiliar with this world-changing concept, please allow me to explain in a personalized example.

David is a strong and intelligent 25 year-old Cape Verdean. He finished high school, but like most people on this small volcanic island of Fogo (“Fire”), there is limited opportunity for him to work or pursue his studies. Though he would like to start his own business, he does not have the capital needed to make the initial investment to get anything started. As a result, he picks up work with a small company that mines stone from the hard earth. But even this grueling work is infrequent, leaving David without a dependable means of income. He and his wife have started to build a house, but up to this point, they have not gotten beyond building a tiny room of concrete blocks; running water and electricity are still a dream away.

The nine inhabited islands of Cape Verde are small, barren and isolated. With very limited rainfall, few natural resources and little arable land, Cape Verde is experiencing hard times, especially during the current drought, which explains why there are more Cape Verdeans living abroad that on the islands themselves. It is a sad, but telling commentary on the depths of this drought to see such beautiful islands abandoned by nearly anyone that has the means to immigrate.

Unlike many of the islanders of Fogo, David does not have family members abroad that can send him money. He would like to earn a stable income and knows that he could earn a living by raising goats, as the goat milk provides an essential source of vitamins and the cheese can be sold to the local community. Once the goats mature and reproduce, the cheese production increases and the young goats can be sold off for a profit. There is land near David’s house that is perfect for grazing animals, but there is a problem: like many people in the developing world, David lacks the start-up capital needed to finance the initial investment. In order to buy 6 or 7 goats, he would need $900. For someone with David’s financial standing, taking out a traditional bank loan in Cape Verde (as is the case in most developing countries) is impossible, as the banks do not offer credit to the poor, many of which cannot provide the collateral required.

For millions, the only source of credit is the local pawnshop or a loan shark that charges exorbitant interest rates, sometimes as high as 1,000%! I have personally seen people in the favelas of Rio that have been threatened and beat up by these loan sharks when they fall behind on their payments. So this leaves David (and MILLIONS like him) in a precarious position, but thankfully micro-credit institutions have stepped in to address the needs of these local entrepreneurs by providing poor people with low-interest loans to start their own business and climb their way out of poverty.

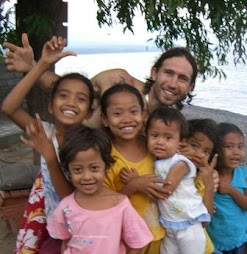

While in Cape Verde , I discovered one such institution OMCV that is doing amazing work with micro-loans, as they were recommended to me by Peace Corps volunteers and local development workers. While visiting David on the slopes of the enormous volcano that towers over the islanders like a sleeping giant, I met Senora Isabel and her husband, who live next door. Three years ago, Isabel took out a $400 micro-loan with OMCV for the same purpose. With the profits from her cheese-making industry, she repaid the loan month-by-month, took out another $400 loan and then last year, due to her credit worthiness, was awarded a larger $800 loan. Today, she and her husband have a flock of 80 goats and a thriving cottage industry of making cheese! With the help of OMCV, they now sell their cheese ($2 a wheel) in bulk to large hotels on neighboring islands with more tourism and have expanded their cramped family shack into a more comfortable 3-bedroom home with a stove and electricity. They are now also raising chickens and can afford small luxuries like a radio, a bedspread and a set of dishes. As she happily recounted to me over a plate of delicious goat cheese, “When I first heard about micro-credit, I had no idea what it was!” She is proud to tell me how she repaid every penny of her loans on time and she and her husband are overjoyed to have found a means to work together to provide income for their family. As they told me, they are able to put some money into a small savings account that acts as an emergency fund, should the need arise.

Visiting David next door, I felt like I was glimpsing into the future. He has witnessed Isabel’s success and knows that micro-loans are the answer to his prayers. He is committed to applying his tireless work ethic to creating his own goat herd and cheese business and knows that by repaying his loans on time, he will be able to take out additional loans to further increase his success. Thanks to the donations of people like you, 100 Friends was able to finance David’s $900 micro-loan.

David, ecstatic upon hearing the news, pledged to dutifully look after his goats with the utmost attention, “as though they are my own babies,” he told me with a smile. This was especially touching to me as I have heard about the human-like qualities of goats: goats milk is said to be very similar to human breast milk, the bleats of many goats sound like crying babies and the eyes strongly resemble humans. Interestingly enough, goats were among the first animals domesticated by humans over 10,000 years ago in present-day Turkey and Iran; the domestication of goats allowed humans to move to more arid lowland regions, marking the transition to the modern era. As humans began to harness the stable food supply that goats provided, they were able to expand into new ecological areas and grow in communal size, which constitutes one of the most fundamental changes on human history. The worship of the half-goat Greek god Pan is further evidence of the goat’s influence on human history. Hopefully, the seven goats David purchases and raises with this micro-loan will allow he and his family to evolve to a more comfortable lifestyle, one free of hunger and hardship.

Best of all, when the money is repaid back into the OMCV fund, it will then be lent out to another local entrepreneur, allowing ANOTHER family to pull themselves out of poverty and create a better life for themselves. This magical, yet simple formula of micro-credit is changing lives all over the world and thanks to your help, the wheels will keep turning.

Labels:

100 Friends,

adam carter,

africa,

beerguy,

micro-philanthropy,

philanthropy

Subscribe to:

Post Comments (Atom)

1 comment:

Thanks for posting this Adam and for the great work you're doing in Cape Verde. Would love to hear the results of your micro-lending endeavors. Keep those wheels turning!

Post a Comment